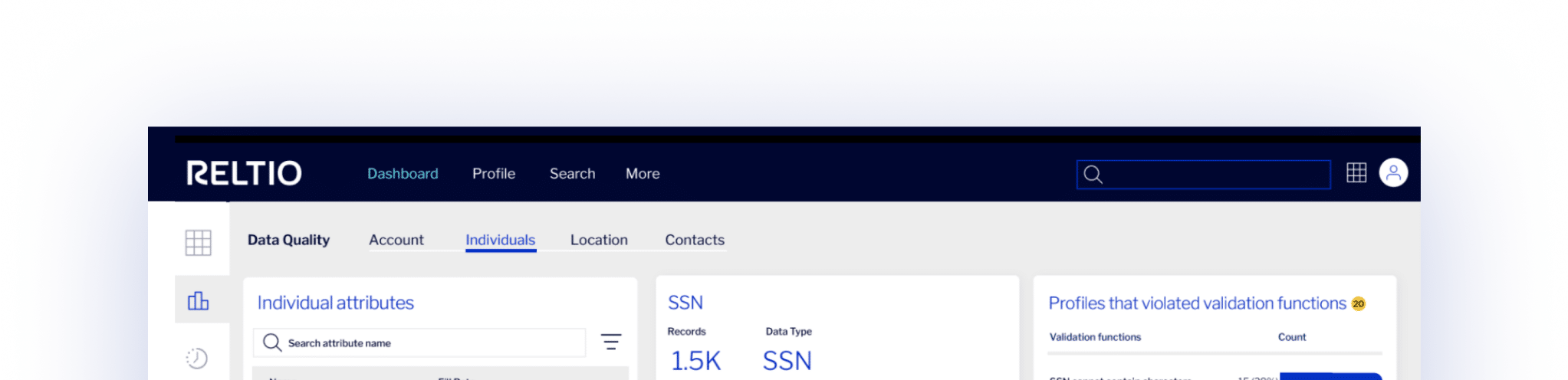

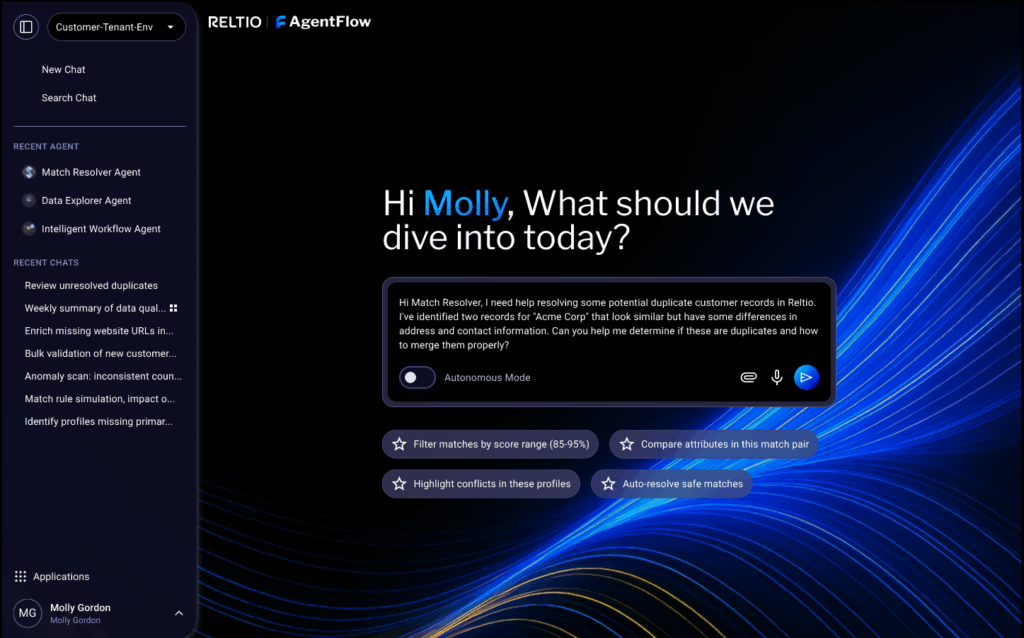

Prebuilt agents for

Agentic AI runs on trusted data. Our secure, purpose-built agents get you there—at high quality.

All built on top of our industry-leading data unification and management platform.

Don't choose—demand both speed and trust of your data.

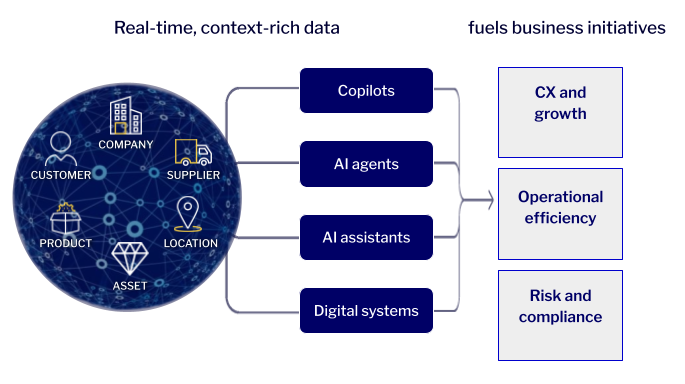

Unify, standardize, enrich, and mobilize your data in real-time to realize the full potential of your digital and AI initiatives

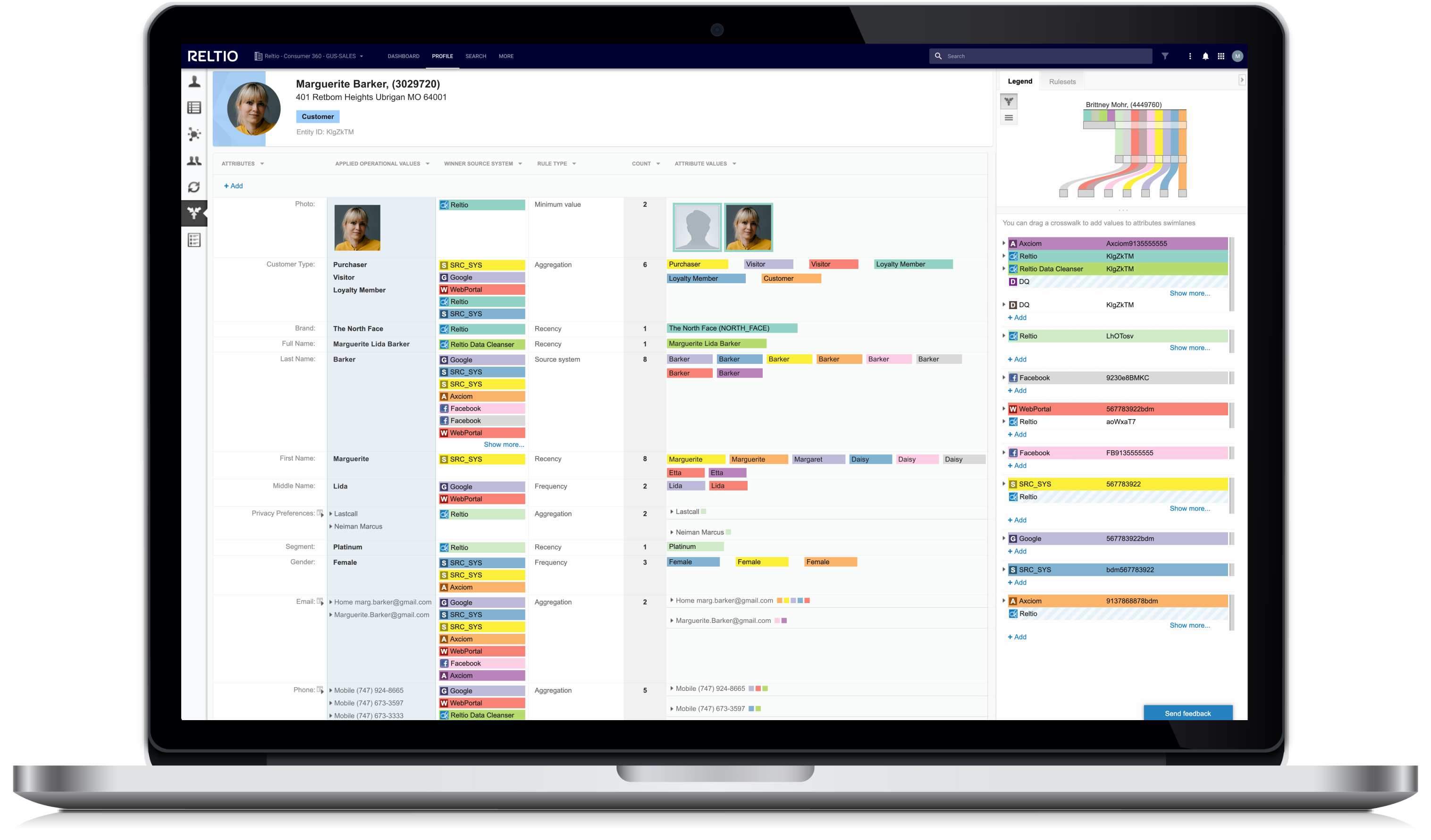

Gain an edge with real-time, unified, context-rich data.

Fuel real-time data intelligence, business operations, and agentic workflows with high-quality, context-rich data.

De-risk your business with high-quality data.

Outdated, siloed data increases risk. Rely on trusted data for operational excellence with compliance and governance.

Deliver personalized customer experiences with fresh, trusted data.

Activate real-time 360-degree profiles to create seamless, differentiated experiences across every touchpoint.

Get your data ready for today and tomorrow.

Modernize your data foundation, clear data debt, and fast-track value with reusable, governed data assets.

Customers at a glance.

15

Fortune 100 companies

140+

Countries with Reltio users

39

Fortune 500 companies

60%

Higher first-call resolution

10X

Faster sales access to data

30%

Increased opportunities

in client base

"Good enough"—no longer good enough. Not for AI, not for growth.

Your business success depends on how fast—and how well—you use your data.

Unlock AI success with context-rich data.

Unify and activate data for AI with agent-enabled operations, LLM-powered matching, and secure, enterprise-grade MCP server.

Industry velocity packs for fast time to value.

Achieves measurable impact in under 90 days—thanks to prebuilt industry models, integrations, and fast-start implementation methodology.

LLM-augmented entity resolution for trusted data.

Pretrained, secure ML models for automatic matching and merging via Reltio Flexible Entity Resolution Networks that incorporate zero-shot learning.

Break free from legacy MDM. Unshackle innovation.

Rapidly migrate to an AI-ready data foundation with minimal risk. Use our prebuilt tools and best practices to speed time to value.

“Reltio’s core capabilities allow for systems to integrate without having to create custom endpoints. This enables new customer experiences to quickly move from experiment to scale without creating additional dependencies.

We wanted a 360-degree view of our customers, and we couldn’t deliver that without having the data, systems, and technology together in a connected format.”

Shamim Mohammad

Executive Vice President & Chief Information and Technology Officer

Continuous innovation.

Immediate value.

Your organization’s reliance on trusted data is growing exponentially. You need innovation that keeps up with your business.

Our genAI-powered, business-responsive SaaS platform unifies and cleanses core data—delivering it in milliseconds wherever it’s needed. Deploy quickly and gain value in just 90 days.

Turn data into a

competitive advantage

As leaders in data management execution, technology, and project implementation, our service partners can help you accelerate value from your data, and deploy Reltio for your success. Made up of leading expert systems integrators, technology vendors, and data providers, consultants and implementation specialists, our partner-experienced network can ease implementation and accelerate impact.

What makes Reltio Data Cloud different?

Ready to see it in action?

Get a personalized demo tailored to your

specific interests.